SBA Loans:

What are they:

An SBA loan is a type of loan that’s designed to help small businesses. The “SBA” stands for the Small Business Administration, which is a U.S. government agency that supports small businesses.

Here’s how it works: The SBA doesn’t actually lend the money directly. Instead, they work with banks and other lenders. When a small business applies for an SBA loan, the SBA promises the lender that they’ll pay back a big chunk of the loan if the business can’t. This guarantee makes the lender feel safer about lending money to small businesses that might be a bit risky.

Because the lender has this extra protection from the SBA, they’re more likely to give loans to small businesses, often with better terms like lower interest rates or longer repayment periods. This makes it easier for small businesses to get the money they need to start or grow.

How do I get one?

To qualify for an SBA loan, businesses need to meet several requirements. Here are the key ones:

Business Size: The business must be classified as a “small business” according to the SBA’s size standards. This varies by industry and is usually based on the number of employees or annual revenue.

Type of Business: The business must be a for-profit entity operating in the U.S. or its territories. Certain types of businesses, like those involved in illegal activities, gambling, or lending, are typically ineligible.

Good Credit: The business owner(s) generally need to have a good personal credit score. Lenders want to see that the owner has a history of paying debts on time.

Business Plan: The business usually needs to present a solid business plan showing how the loan will help the business grow or sustain itself.

Equity Investment: Owners may need to invest some of their own money into the business before seeking an SBA loan. This shows that the owner is committed to the business.

Collateral: While not always required, having collateral (like property or equipment) can help secure the loan. If the business can’t repay the loan, the lender might take the collateral as payment.

Ability to Repay: The business must demonstrate the ability to repay the loan, often by showing financial statements, cash flow projections, and tax returns.

No Delinquent Debts to the Government: The business and its owners must not be delinquent on any existing debt obligations to the U.S. government, such as student loans or taxes.

Use of Funds: The loan must be used for a legitimate business purpose, like buying equipment, inventory, or real estate, or to manage working capital.

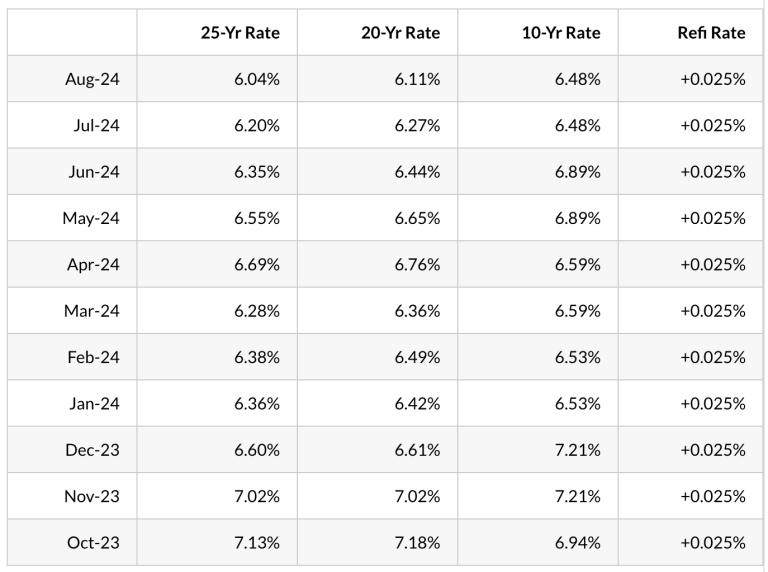

2024 SBA Interest Rates: